How to Invest in Real Estate Without Money or Credit

Starting your real estate journey with no cash or credit can seem daunting, yet alternative methods pave the way. Through wholesale contracts, owner carryback, rent-to-own agreements, and joint ventures, you gain property control with little to no money down. In this article, discover practical methods to gain and monetize real estate access with no cash or credit.

For more information on investing without cash or credit, go to: real estate software for investors

Innovative No-Money-Down Techniques

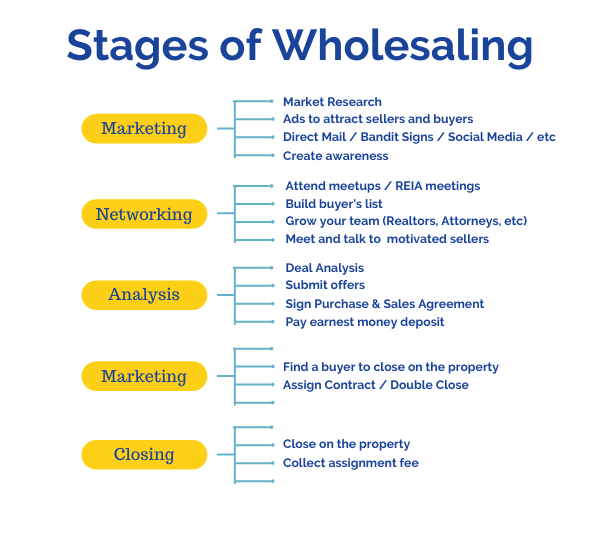

Wholesaling lets you lock in discounted purchase contracts and flip them to end buyers without funding the purchase yourself. With wholesaling, no personal capital or credit checks are required, yet profits can be realized quickly. Success relies on mastering lead generation, market analysis, and negotiation skills to match motivated sellers with cash buyers.

Seller Financing & Lease Options Explained

Owner financing allows you to negotiate payments with the seller, bypassing traditional mortgages. A lease-option contract locks in purchase terms while you build equity through rent credits. These methods give immediate property control and deferred payment responsibilities.

Joint Ventures & Partnerships

Joint ventures allow you to contribute market knowledge while your partner provides funding. JV contracts outline roles and revenue shares, creating clarity and trust. A well-drafted joint venture agreement with transparent objectives secures smooth collaboration.

Tools & Resources for No-Cash Investing

Integrating lead management systems with property calculators helps you prioritize the best opportunities. Digital hubs for real estate investing often feature exclusive no-money-down deal listings. Educational platforms deliver proven tactics and real-world examples for mastering alternative property funding.

Best Practices for No-Money-Down Deals

Detailed research on ownership and repair needs protects your profits and reputation. A strong buyer pipeline is crucial for seamless contract transfers. Effective negotiation and honest value articulation secure profitable deals.

Discover additional creative financing strategies, visit: real estate investor crm software

Final Thoughts on No-Cash Real Estate Investing

Although challenging, zero-down approaches can lead to profitable ventures with the right plan. By utilizing wholesaling, seller financing, lease options, and joint ventures, you can build a scalable investment business with minimal capital. Start by educating yourself, forming solid legal agreements, and cultivating a network of buyers and partners. Through consistent effort, ethical practice, and adaptive learning, you can turn zero-down deals into lasting success.